If you’re busy dreaming about entering the property market but finding hard to save for a deposit, there’s good news for you and we’re not just talking about the interest rate pause.

From 1 July, changes to the ‘first home guarantee’ (FHG) mean you can now access the guarantee to buy your home with a friend or family member. Previously, the guarantee was only available to married or de facto couples, and singles.

There’s actually lots of assistance packages, grants and stamp duty exemptions available now that make buying easier than ever before, and this new change to the FHG will be a game changer for buyers.

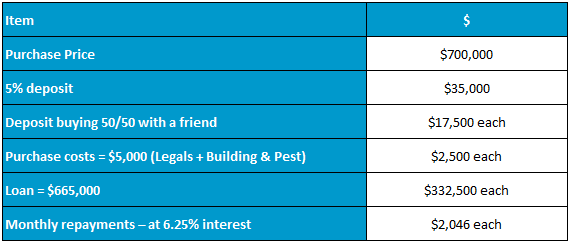

For example, if you’re targeting a purchase price of $800,000, the funding would look like this:

With weekly repayments of $511 per week, or lower if your purchase price is lower – it makes a case for ditching your rental and switching to becoming an owner.

Of course, buyers should go in with their eyes open because being able to buy a great property is not only about the money.

We call this approach ‘buddy buying’ and suggest buyers should draw up an agreement to cover off issues such as how you’ll cover expenses, how long you’ll stay in the property, and the key reasons you would consider selling.

Then the other critical step is to make good choices about what you’ll buy. To help with the buying process we have developed the ‘Buyer Success Program’ which covers the key factors buyers need to make great purchases in the current market.

Don’t wait too long because there are limited spots for the FHG each year.

About the author

Debra Beck-Mewing is the Editor of the Property Portfolio Magazine and CEO of The Property Frontline. She has more than 20 years’ experience in buying property Australia-wide and has extensive experience in helping buyers use a range of strategies including renovating, granny flats, sub-division and development. Debra is a skilled property strategist, and a master in identifying tailored opportunities, homes and sourcing properties that have multiple uses. She is a Qualified Property Investment Advisor, licensed real estate agent and also holds a Bachelor of Commerce and Master of Business. As a passionate advocate for increasing transparency in the property and wealth industries, Debra is a popular speaker on these topics. She is also an author, podcast host, and participates on numerous committees including the Property Owners’ Association.

Follow us on facebook.com/ThePropertyFrontline for regular updates, or book in for a strategy session to discuss your property questions.

Disclaimer – This information is of a general nature only and does not constitute professional advice. We strongly recommend you seek your own professional advice in relation to your particular circumstances.