Welcome to the October 2021 property market update. Outlined below is a compilation of data sets which provide insight into how the market has performed to date, and also indicators for where the market is heading.

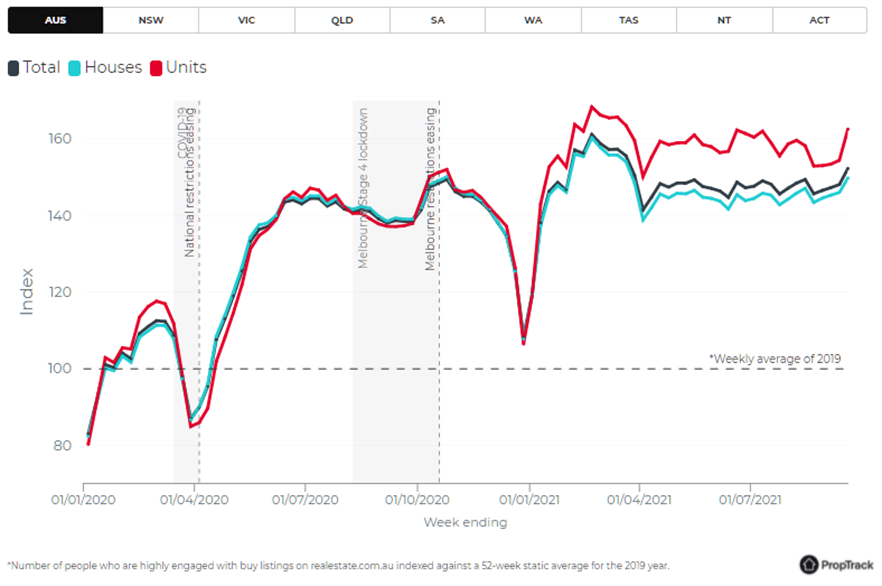

REA Buyer Demand – as at 30 September 2021

The PropTrack Buyer Demand Index, which measures high-intent buyer activity on realestate.com.au, increased more than 5% over the past three months with the majority of the change occurring over the past week.

Much of this increase was driven by Victoria, which saw demand soar by 7.5%. This seems in response to in-person property inspections returning in Victoria, following 70% of the adult population reaching partially-vaccinated status.

Demand also increased strongly in New South Wales and the ACT, with the end of the most onerous restrictions in these markets insight.

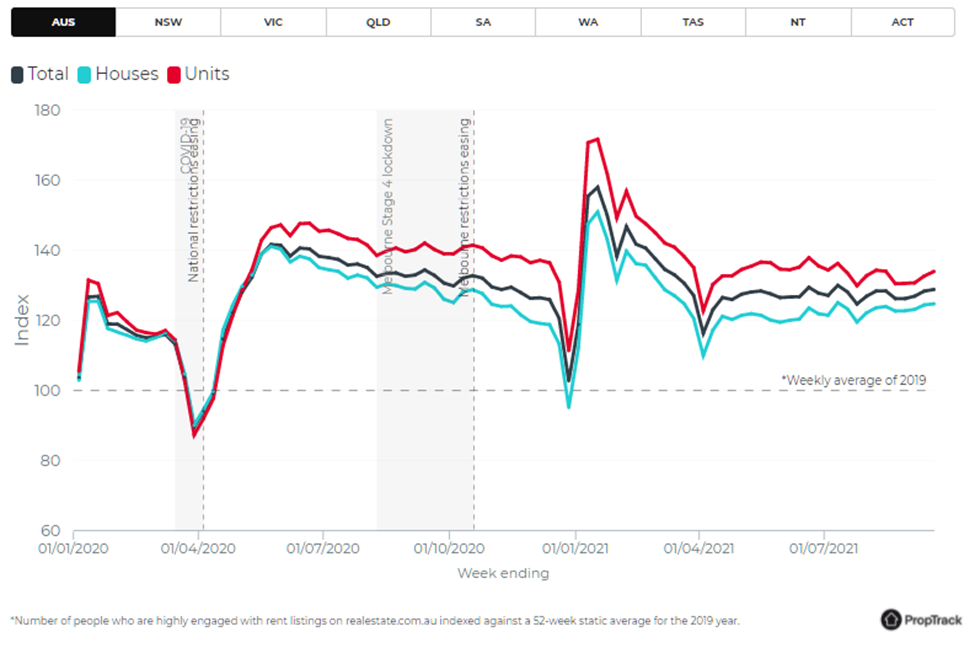

REA Rental Demand – September 2021

The PropTrack Rental Demand Index, which measures high-intent rental activity on the platform, has experienced marginal increases (0.4%) over the past three months.

Rental demand was mixed across states and territories although the largest increases were seen in Victoria and the ACT, despite their ongoing lockdowns.

Aggregate rental demand is around the same level as a year ago, when we saw a strong period of housing demand after national lockdowns were lifted.

While rental demand remains about 20% below the peak recorded in January this year, the level of demand remains 25% higher than the average over 2019, before the pandemic.

This is surprising given that foreign students and other migrants – traditionally a strong source of rental demand in inner-cities – remain unable to enter the country.

It shows the effect returning expatriates have had on rental markets and that many Australians are still reassessing where they want to live, and what they want to live in, as the pandemic rolls on.

Reserve Bank Market Tracking

Included below is information tracked by the RBA and used for the monthly meetings where interest rates / cash rates are decided.

For the month ending 30 September :

- Nationally Housing Prices (LHS graph) are trending up and reached the past peak of 2010 (see red circled area of graph). This would be a major concern for the regulators, as prices have steamed quickly past the market peak of 2017 (see the red cross area of the graph). The peak of 2017 prompted the regulators to step in with restrictive funding practices which caused the property market to hit the wall. Actions will need to be taken soon to temper the market as it has clearly reached historically high levels.

- Home lending still outstripping investors by 20% although home lending appears to have peaked.

SQM Research Asking Prices

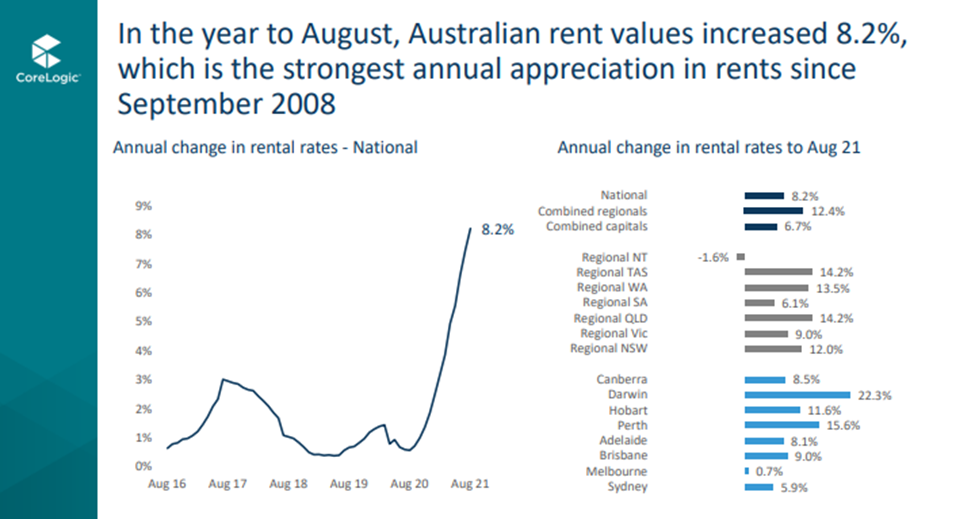

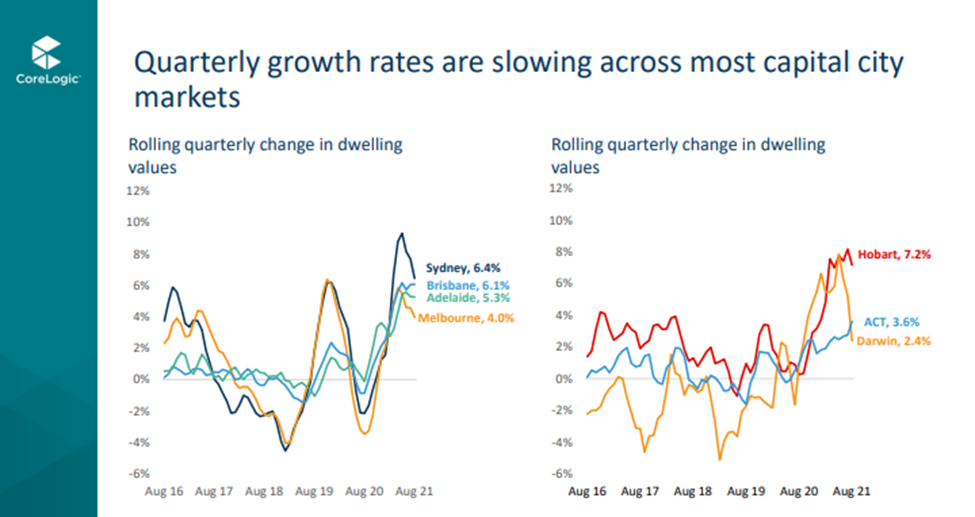

RP Data / Core Logic Monthly Update

This information is also used by the RBA for further property market insights. Note that the data is approximately six weeks old – for example, the 1 October report, charts market performance ruled off at 31 August.

About the author

Debra Beck-Mewing is the Editor of the Property Portfolio Magazine and CEO of The Property Frontline. She has more than 20 years’ experience in buying property Australia-wide and has extensive experience in helping buyers use a range of strategies including renovating, granny flats, sub-division and development. Debra is a skilled property strategist, and a master in identifying tailored opportunities, homes and sourcing properties that have multiple uses. She is a Qualified Property Investment Advisor, licensed real estate agent and also holds a Bachelor of Commerce and Master of Business. As a passionate advocate for increasing transparency in the property and wealth industries, Debra is a popular speaker on these topics. She is also an author, podcast host, and participates on numerous committees including the Property Owners’ Association.

Follow us on facebook.com/ThePropertyFrontline for regular updates, or book in for a strategy session to discuss your property questions.

Disclaimer – This information is of a general nature only and does not constitute professional advice. We strongly recommend you seek your own professional advice in relation to your particular circumstances.