Sydney house prices have soared to a record-breaking $1,309,195, rising more than $100,000 in the first three months of this year, new figures reveal, the fastest quarterly gain in almost 30 years.

The median house price jumped 8.5 per cent in the first quarter of 2021, according to the latest Domain House Price Report released on 30 April. It is the fastest quarterly growth since Domain records began in 1993.

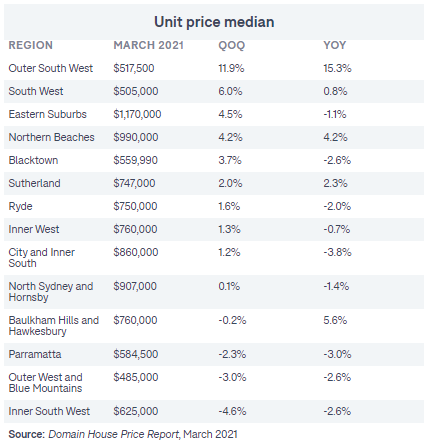

The unit recovery has also picked up, with the median price rising 2.2 per cent over the quarter to $751,038.

The persistent lack of stock in the face of unabated high levels of buyer demand and ultra-low interest rates has continued to fuel this “extremely rare” rate of growth, according to Domain senior research analyst Nicola Powell.

She said it was a “turnaround” for the unit market as investors began to trickle back to the market at the same time priced-out house buyers opted to purchase more affordable units.

But it’s unlikely to last: buyers could expect these “extraordinary conditions” to ease in following months, Dr Powell said.

“More homes will be listed for sale. Affordability will bite not just for first-home buyers but for those who are likely to upsize,” Dr Powell said.

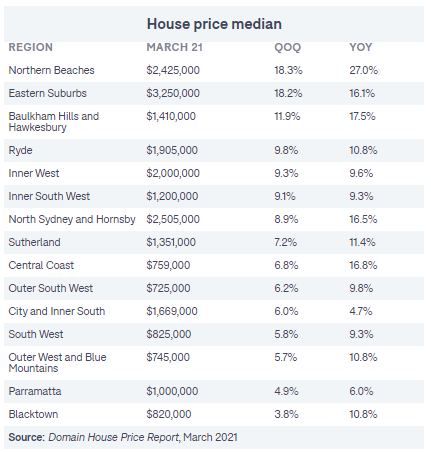

The housing market grew in almost every region of Sydney in the first quarter of 2021, in particular in those lifestyle locations where working from home became the norm for many well-heeled white collar workers.

The northern beaches jumped by a massive 18.3 per cent – or $375,000 in the space of three months – to a median of $2.425 million.

It has left hopeful northern beaches home buyer Brendan Page priced out of the area and at the point of giving up on buying a house altogether.

The 37-year-old, who has been house hunting on the northern beaches since the end of last year, has upped his budget to about $2 million and compromised on his search but has still not been able to get into the market.

“We effectively got to our least preferred suburbs, a steep block and no yard, and they were going in excess of our budget, and we were at a point where we said enough is enough,” Mr Page said.

“It’s hard to imagine that the entry-level freestanding house will continue to increase on the northern beaches because I don’t understand who can be buying those properties.”

Mr Page is not alone, according to Mortgage Choice Dee Why principal and mortgage broker James Algar, who said buyer fatigue was starting to set in and the rate of growth was catching out many well-heeled Sydneysiders.

“Even those who are earning good money can’t save $200,000 or $300,000 a year, which is what you have to save to keep pace with home price growth. Not even the top one per cent can save that.

“Unless you bought Bitcoin there are very few assets keeping up with the housing market.”

Houses at the upper end of the market were leading the charge, with the median house price in the eastern suburbs, rising by a massive 18.2 per cent over the quarter to $3.25 million.

It was followed by the Baulkham Hills and Hawkesbury region, where the median house price rose 11.9 per cent to $1.41 million.

Last year’s dire forecasts of major house price falls never eventuated thanks to the combination of income support payments and mortgage repayment holidays that largely cushioned the housing market, said Shane Oliver, chief economist of AMP Capital.

Since then the improving jobs market, ultra-low interest rates, government incentives and buyers’ fear of missing out had stimulated the rapid growth into the new year.

“Those things have swamped the fact we’ve had a recession and some people have been struggling to meet their mortgage repayments,” Dr Oliver said. “The reality is, the bulk of people’s jobs were protected and the repayment holidays made sure there wasn’t a huge spike in defaults.”

He expected the rate of growth to slow in following months as the “sugar hit” from fixed-rate loans wears off and pent up demand slows down.

The biggest drivers of this house price recovery were led by the improving unemployment rate and a competitive interest rate environment that had offset the effects of near-zero population growth since international borders closed, said Jo Masters, chief economist at EY Oceania.

“What we’ve seen is not just the impact of just low interest rates but the messaging it will stay low for years and the fact the labour market has done better than expected,” Ms Masters said. “It’s generated more domestic demand than we’ve lost from migration demand.”

If house prices continued to rise at this rate and the house price cycle was driven more by investors and riskier loans later through the year, macroprudential controls could be set in motion to cool the market, Ms Masters said.

“If we saw a deterioration in lending standards then I would expect to see macroprudential controls designed to cool the market.”

About the author : This article first appeared in Domain.