Australian capital city dwelling prices will rise in 2021 as a result of this year’s aggressive government stimulus, interest rate cuts and the upcoming changes to responsible lending laws, according to Christopher’s Housing Boom and Bust Report 2021, released today by SQM Research.

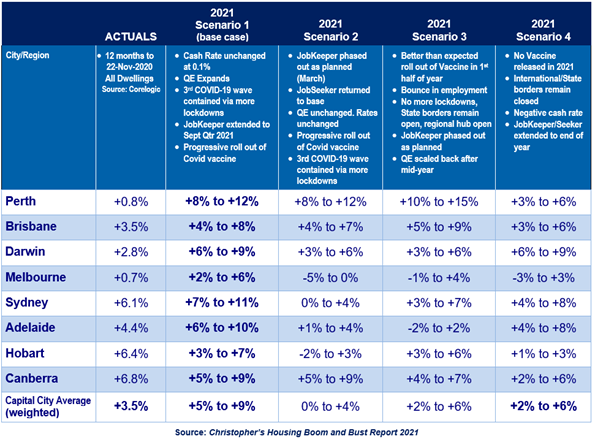

The base case forecast is for dwelling prices to rise between 5% to 9% with the city of Perth to be the outperformer next year, followed closely by Sydney and Adelaide.

The base case forecasts assume ongoing support from the Federal Government and the Reserve Bank of Australia over 2021. The forecasts also assume a progressive rollout of a Covid-19 Vaccine and the potential for a 3rd wave of the virus.

Importantly, an extension of JobKeeper is regarded as essential for the ongoing momentum of the housing recovery, which appears to have formed from the end of the September Quarter 2020. If JobKeeper is scaled back too prematurely, the housing market recovery in Sydney and Melbourne could stall.

Perth is forecast to rise between 8% to 12% on the back of an ongoing recovery in the base commodities market, further encouraging mining-based project investment. There now exists a significant shortage of Perth rental properties which translated into a greater than 9% rise in market rents over 2020. This shortage is very likely to translate into even faster rent increases and stronger buyer activity in 2021.

Melbourne is forecast to rise at a more subdued rate of 2% to 6% due in part to the extended lockdowns in 2020, destroying many small businesses and so likely delaying a jobs recovery. The ongoing international border closures combined now with evidence of current interstate migration outflows will also put Melbourne at a disadvantage. Nevertheless, rate cuts as well as State and Federal Government stimulus will put a floor underneath the Melbourne market for houses. CBD units are expected to record ongoing price declines.

Leading indicators such as auction clearance rates and asking prices for Sydney are suggesting a forming recovery in the middle and outer rings. Inner city units continue to record price falls for which we do not expect this trend to change. The overall Sydney forecast is for a 7% to 11% dwelling price increases. The proposed NSW Stamp Duty/Land Tax opt-in for home buyers will be stimulatory to the housing market next year.

Louis Christopher, Managing Director of SQM Research said, “As 2020 draws to a close, the national housing market has responded to the unprecedented economic stimulus packages as well as record low lending rates. Auction clearance rates have lifted since mid-year and various dwelling price measurements have started to record price rises. It is likely that the housing market will gain further momentum on the back of increased investor activity, especially from those who seek some sort of income yield.

“However, we have some misgivings on the longer-term consequences of these new stimulatory policies. If housing is regarded as an asset class that is not allowed to fall, Australia could have some rather serious social issues surrounding home ownership rates over the long term. In the meantime, risks have risen that this new recovery will be one of the more speculative rises seen in some time. Let’s keep in mind unemployment remains elevated and net migration is expected to be negative next year. We have a surplus of inner-city units in our two largest cities. And if there was another negative macro event in 2021, there is not much room left to cut lending rates further.

“Many in the community are starting to think they cannot ever lose on housing. That the Government will always be there to step into the housing market, if need be. And that is a scary idea…”

Christopher’s Housing Boom and Bust Report also has a full breakdown of every postcode in the country covering current market statistics and its postcode investor ratings. Click here to purchase your report for $59.95.

About SQM Research

SQM Research Pty Ltd is a respected Australian investment research house, specialising in providing research and data across all major asset classes.

Enquiries: linda@sqmresearch.com.au +61 2 9220 4603