Our analysis this week covers how the Australian property market is performing against the backdrop of global property markets . . .Australia versus the world.

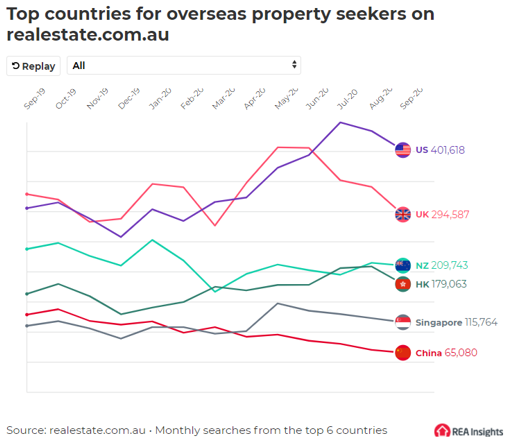

The first chart below tracks overseas interest in buying property in Australia, mapped by the country showing interest. The highest level of activity is from the United States market with just over 400,000 buyers registering interest, the United Kingdom (UK) is fairly consistent with the same time last year, and enquiries from China showing the greatest downturn in activity.

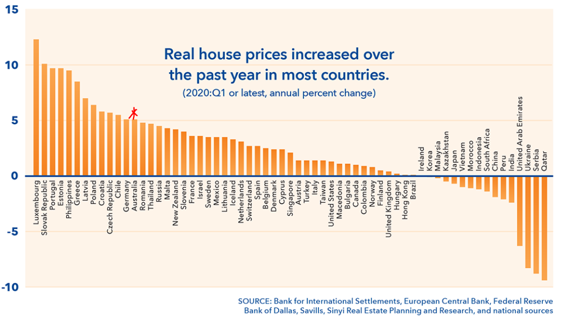

The following chart tracks house price changes as collated by the International Monetary Fund over the 12 month period to 31 July 2020 (these are the latest figures available). Luxembourg was the winner with the largest price increase, and Qatar the biggest drop. Australia landed towards the higher end, mapping a 5% increase during the period.

Next, we have a chart that maps housing ‘affordability’ by analysis of the difference between house price growth and wages growth over the past 12 months to 31 July 2020. Once again Luxembourg showed the largest difference – meaning wages growth was quite small in comparison to house price growth. Italy was on the other end of the scale, where incomes actually grew at a higher percentage when compared to house price growth. Australia is in the mid range where house prices appeared to increase by 8% in comparison to wages growth.

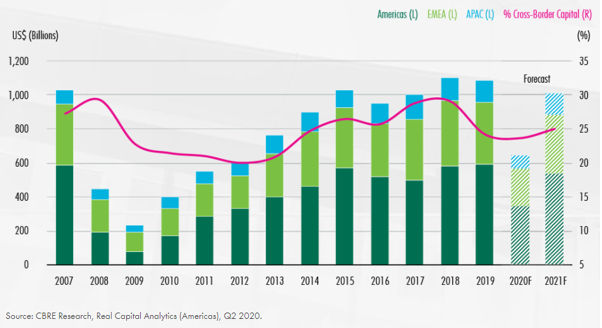

By way of considering the property market forecast, the final chart outlines the view from global commercial builders CBRE who are forecasting a ‘dip’ to prices globally for 2020 – though not as large of an impact as 2008-2010 – and then a fairly significant bounce back in 2021. That is . . as long as we get the virus under control.

About the author

Debra Beck-Mewing is the Editor of the Property Portfolio Magazine and CEO of The Property Frontline. She has more than 20 years’ experience in buying property Australia-wide and has extensive experience in helping buyers use a range of strategies including renovating, granny flats, sub-division and development. Debra is a skilled property strategist, and a master in identifying tailored opportunities, homes and sourcing properties that have multiple uses. She is a Qualified Property Investment Advisor, licensed real estate agent and also holds a Bachelor of Commerce and Master of Business. As a passionate advocate for increasing transparency in the property and wealth industries, Debra is a popular speaker on these topics. She is also an author, podcast host, and participates on numerous committees including the Property Owners’ Association.

Follow us on facebook.com/ThePropertyFrontline for regular updates, or book in for a strategy session to discuss your property questions.

Disclaimer – This information is of a general nature only and does not constitute professional advice. We strongly recommend you seek your own professional advice in relation to your particular circumstances.