According to Domain Research, Australia’s housing market will be in a well-established, steady recovery over this (2023-24) financial year.

Domain forecasts house prices in Sydney, Adelaide and Perth, and unit prices in Brisbane, Adelaide and Hobart, could have fully recovered from the 2022 downturn by this time next year. Adelaide and Perth house prices are predicted to rise slowly and may avoid a downturn, but see a period of modest or sideways growth (for which Adelaide is renowned).

Regional Australia will see a slower growth pace than the combined capitals but Gold Coast houses and units – if you count the Gold Coast as ‘regional’ – will be at a new record high by 30 June 2024.

The reason for price strength

Market forecasters with good experience and independent views all point to population increases as the reason property prices will remain strong. Australia is projected to receive 1,235,000 net overseas migrants over the next four years, requiring an additional 497,984 homes by 2025-2026.

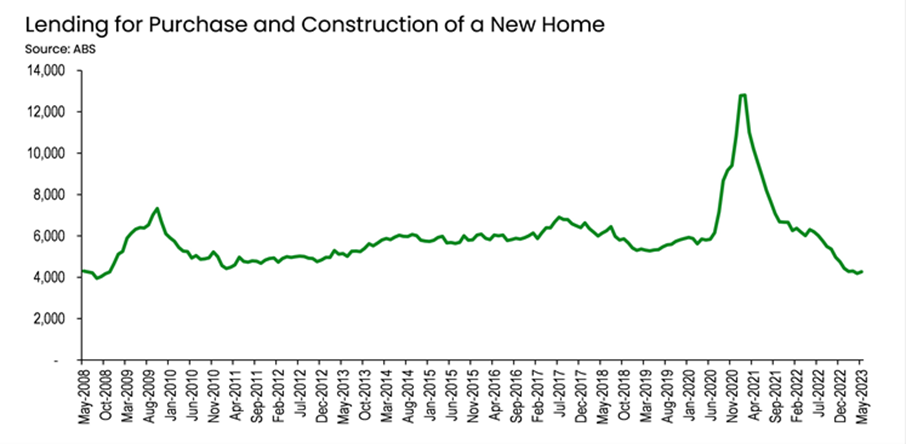

I’m guessing it won’t come as a shock to you that we have zero chance of meeting these targets if construction commencements continue on as outlined in the following chart.

This means rents are forecast to remain strong, though some short term easing could be on the horizon.

Leaps and dips of rental pricing

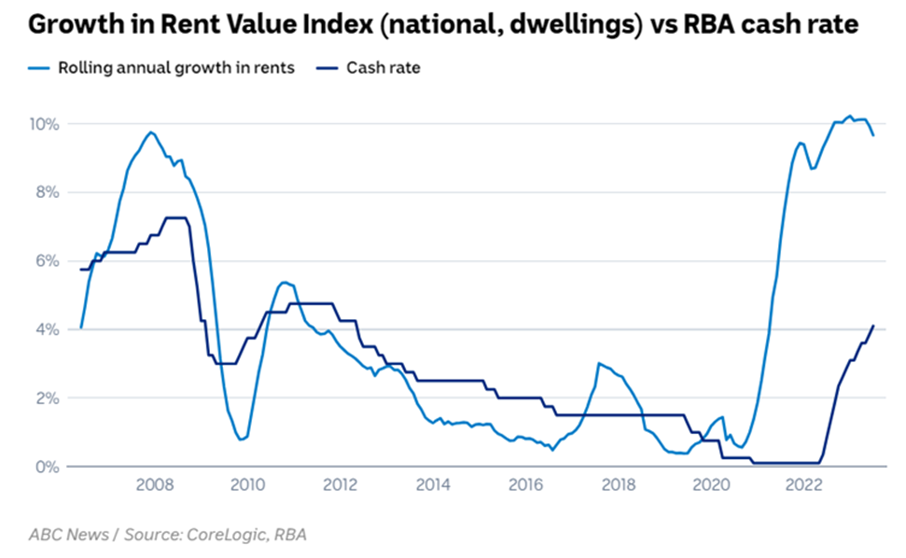

The chart below tells the real story about rents. It shows national rent value mapped against changes to the RBA cash rate, but if you know anything about the supply story, this chart is absolute proof that low supply causes rent increases.

In particular, the rent peak in 2008 was also the time investors sold out of the market during the GFC. The government encouraged investor activity to stimulate the market in 2009, and with more investors, rents dipped.

After the jump in investor activity in late 2009 rents dropped, then bounced up after investment lending was restricted in 2010, then dropped again after 2011 as investors and developers delivered more supply to the market.

Hanging in there

By the end of 2016, investment lending was again constrained. In addition, Federal Labor was confident of winning the next election and was making very loud noises about what they were going to do with negative gearing. Investors started pulling out of the market and rents bounced up . . until mid 2019 when Federal Liberals were elected.

As investor activity increased, rents dropped until the main force of the COVID pandemic really hit Australia. At this point housing requirements changed, supply absolutely tanked and . . you guessed it . .rents bounced upwards.

I’m sure you’re quite across this point, but I am always astounded that so many ‘experts’ say high rents are caused by property owners raising rents. The data shows that rents can only be increased if there is significant demand.

So what does all this mean to you? Basically the massive supply shortage is set to continue for many years so rental prices look solid for quite some time. The chart below shows rents starting to ease, but with continued high migration any dips are expected to be shallow and short lived.

But is it real?

There’s currently undeniable evidence that we don’t have enough properties to meet our housing requirements in Australia. But the real story is that no one really knows how bad the supply shortage is. If we don’t have visibility on the real numbers, it will be impossible to find practical, long term solutions.

In a step in the right direction, Dr Peter Tulip, Chief Economist at the Centre for Independent Studies, has recently released a research paper ‘Where should we build new housing – Better targets for local councils’. With a background as Senior Research Manager for the Australian Reserve Bank, Dr Tulip has a particular specialty in this area.

Next week, Dr Tulip will provide insights into his views on solving the housing supply issue at a webinar hosted by the Property Owners Association of NSW. This will include his suggestions for where we should be building which will be invaluable insights for buyers as well as property owners. Tickets are limited, so jump in to grab your seat. Click here for more information and how to book.

Hope to see you at the event!

About the author

Debra Beck-Mewing is the Editor of the Property Portfolio Magazine and CEO of The Property Frontline. She has more than 20 years’ experience in buying property Australia-wide and has extensive experience in helping buyers use a range of strategies including renovating, granny flats, sub-division and development. Debra is a skilled property strategist, and a master in identifying tailored opportunities, homes and sourcing properties that have multiple uses. She is a Qualified Property Investment Advisor, licensed real estate agent and also holds a Bachelor of Commerce and Master of Business. As a passionate advocate for increasing transparency in the property and wealth industries, Debra is a popular speaker on these topics. She is also an author, podcast host, and participates on numerous committees including the Property Owners’ Association.

Follow us on facebook.com/ThePropertyFrontline for regular updates, or book in for a strategy session to discuss your property questions.

Disclaimer – This information is of a general nature only and does not constitute professional advice. We strongly recommend you seek your own professional advice in relation to your particular circumstances.