The announcement of further changes to tenancy regulations by both NSW Liberal and Labor parties is set to drive more property owners out of the market, causing more rental market pain at a time when supply needs to be increased.

“The Government is yet again kicking the can down the road, intensifying the rental crisis and increasing financial difficulties for an ever-increasing number of Australians”, said John Gilmovich, President of the Property Owners’ Association of NSW.

“The current approach of squeezing property owners with restrictive regulations is not the ‘solution’ to the rental crisis and is driving property owners out of the market, lowering the supply of rental properties and making the problem worse”, he said.

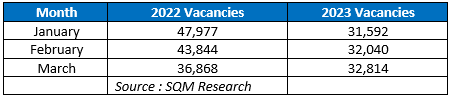

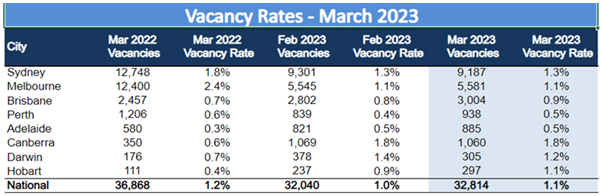

Rental markets nationally are tight, with the national vacancy rate sitting at just 1% according to SQM Research. More dramatically, available properties have dropped by a stunning 34% year on year to January 2023.

The current rising rents will be exacerbated by more radical policy changes which are presumably intended to address housing shortages, but are misguided and poorly constructed. This is not only in NSW but right across the country.

For example, when the Victorian Government introduced their latest round of landlord restrictions, Melbourne experienced a decrease in rental supply of 36.5%.

The appetite for investment is being further subdued by growing land tax bills, increased mortgage costs and ongoing campaigns blaming property owners for the current market issues.

“We’re seeing this impact long term owners and POANSW members. Recently, a group of owners who collectively provide more than 50 rental apartments in Sydney have advised they plan to sell their properties and re-deploy capital,” Mr Gilmovich said.

POANSW has repeatedly offered the NSW government the opportunity to assist in the development of sensible policies that would actually address housing supply and rental prices across the state, however, to date the NSW Government appear to have a limited appetite for any genuine change beyond populist and ill informed policies that will ultimately exacerbate the problem.

At a time when NSW is opening back up, and the Federal Government is encouraging more people to come to Australia for work, we need to increase supply of housing and encourage property owners to offer their properties to the rental market.

Instead, all levels of Government, from local through to State and Federal Governments, seem to be intent on driving property owners out of the market, and making it harder for people who want to enter.

FACT SHEET

Rents returning to pre COVID levels

Rents are directly related to the relationship between supply and demand. This was explicitly visible during the COVID pandemic, where demand was artificially constrained by government restrictions. SQM research shows a drop from pre-COVID average apartments rents in Sydney of $502/week in July 2019 to a low of $444 per week by January 2021. The actual low rent was even lower than the statistics indicate as during this period, as tenants were also being regularly offered incentives such as rent free periods.

Now that demand has returned to the marketplace, there is a critical lack of appropriate rental stock, and average rents have ballooned to $623/week in February 2023 according to SQM research.

Increasing rental supply means building more housing – a variety of housing types across all markets. Houses, apartments, townhouses, boarding house rooms. This is required in all areas of Sydney from the Eastern Suburbs to the Upper Northshore and Western Sydney.

Local, State and Federal government stands in the way

The planning system and state and federal tax system do not allow for quick deployment of housing. A complex and high risk planning regime, an adversarial approval process, and an expensive planning system are all barriers that have contributed to an under supply of housing. According to the ABS, in December 2022 there was a reduction in dwelling approvals across the country of 3.8% for units and 11.7% for houses compared to the previous 12 months.

The current complex system can be navigated by large developers with significant resources who can weather major risks to their money. This includes publicly listed companies and very large developers. But, this won’t provide an adequate supply pipeline for the people of NSW.

We need a system that encourages all property owners, particularly small investors with 1-3 properties to invest more and expand their offerings, providing more rental housing. Without this fundamental policy change, the critical undersupply will persist and worsen. And, the result will be rising rents.

This article first appeared in POA-NSW.

About the author

Debra Beck-Mewing is the Editor of the Property Portfolio Magazine and CEO of The Property Frontline. She has more than 20 years’ experience in buying property Australia-wide and has extensive experience in helping buyers use a range of strategies including renovating, granny flats, sub-division and development. Debra is a skilled property strategist, and a master in identifying tailored opportunities, homes and sourcing properties that have multiple uses. She is a Qualified Property Investment Advisor, licensed real estate agent and also holds a Bachelor of Commerce and Master of Business. As a passionate advocate for increasing transparency in the property and wealth industries, Debra is a popular speaker on these topics. She is also an author, podcast host, and participates on numerous committees including the Property Owners’ Association.

Follow us on facebook.com/ThePropertyFrontline for regular updates, or book in for a strategy session to discuss your property questions.

Disclaimer – This information is of a general nature only and does not constitute professional advice. We strongly recommend you seek your own professional advice in relation to your particular circumstances.