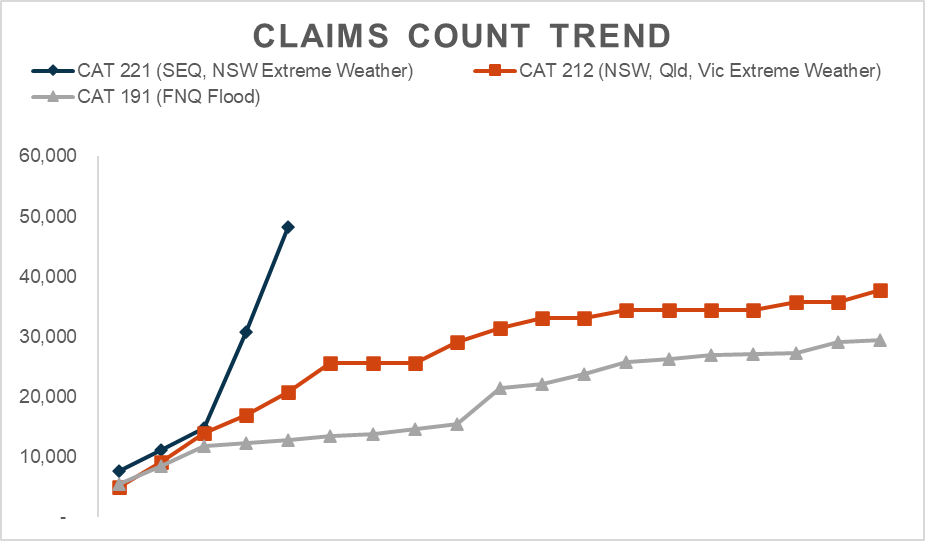

The Insurance Council of Australia (ICA) today said insurers have received 48,220 claims related to the flooding in South-East Queensland and the New South Wales coast.

This is a 53 per cent increase on yesterday’s claims count and demonstrates the significant impact of this event. (see graph below)

37,807 of these claims are from Queensland, with the remainder from New South Wales. New South Wales figures are expected to increase in coming days as more policyholders return to their homes and businesses.

Eight-four per cent of total claims relate to property, with the remainder motor vehicle. Insurers do not have an estimate of claims costs at this time.

ICA CEO Andrew Hall is in Brisbane today meeting with State and Federal Government stakeholders to report on insurers’ activity and to ensure the recovery process fully supports impacted communities.

This has included discussion of the availability and affordability of flood cover.

The ICA has been working with members to conduct an aerial survey of the impacted zones to prepare high-resolution imagery of the event.

Commencing today an aerial survey will be undertaken of Lismore, Ballina, Grafton, Murwillumbah, Gympie, Maryborough, Brisbane and Logan.

The overall aim of this program is to:

- Verify the impact and scale of the event

- Improve the response time of insurers through accurate assessment of property conditions

- Work collaboratively with Government response and recovery agencies by providing them with access to the captured images

Quote attributable to Andrew Hall, CEO, Insurance Council of Australia:

Following the 2011 Brisbane floods insurance policies now have a standard flood definition.

If a policyholder has opted out of flood they are most likely still covered for storm damage, and if they are unsure they should speak with their insurer.

Insurance prices risk, and that means that for those in flood-prone locations, particularly small businesses, flood cover can be costly.

That is why the ICA has called on all Australian governments to do more to protect homes, businesses, and communities from the impacts of extreme weather.

With appropriate mitigation infrastructure and household-level programs, property can be better protected and premiums can decrease, but this can only be achieved if governments act with urgency.

Remember

- Safety is the priority – don’t do anything that puts anyone at risk

- Only return to your property when emergency services give the go ahead

- If water has entered the property, don’t turn on your electricity until it has been inspected by an electrician

- Contact your insurance company as soon as possible to lodge a claim and seek guidance on the claims process

- Property owners who have sustained roof damage should advise their insurer, your insurer will arrange emergency works to minimise any hazards and prevent further damage. This can include isolating damaged solar panels or electrical circuits and installing a roof tarp

- Don’t worry if you can’t find your insurance papers – insurers have electronic records and need only your name and address

What to do if your property has been impacted by flooding and storms

- You can start cleaning up but first take pictures or videos of damage to the property and possessions as evidence for your claim

- Keep samples of materials and fabrics to show your insurance assessor

- Remove water damaged goods from your property that might pose a health risk, such as saturated carpets and soft furnishings

- Make a list of each item damaged and include a detailed description, such as brand, model, and serial number if possible

- If water has entered the property, do not turn on your electricity until it has been inspected by an electrician

- Store damaged or destroyed items somewhere safe where they do not pose a health risk

- Speak to your insurer before you attempt or authorise any building work, including emergency repairs, and ask for the insurer’s permission in writing. Unauthorised work may not be covered by your policy

- Do not throw away goods that could be salvaged or repaired

This article first appeared in Insurance Council of Australia.