Give yourself a pat on the back for making it to the end of one of the rockiest financial years on record.

FY20 started with a bang after the surprise result from the Federal election which accompanied a surge in property market activity. By September the market was red-hot with buyers paying upwards of 30% over asking price to access their target purchases.

The market continued to rampage even throughout the horrendous bushfires and then hit the brakes when the COVID-19 restrictions were introduced.

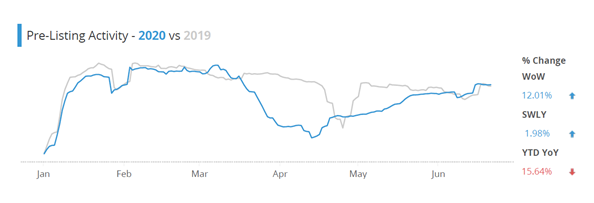

The story is underlined by the numerous graphs charting different aspects of activity. An interesting view is the graph below produced by CoreLogic.

This charts the number of market analysis reports requested by agents between January and June 2019 (the grey line) and 2020 (the blue line). The analysis reports are an indication of pre-listing activity as agents run the reports in preparation for listing properties for sale.

There’s many observations to be made, but two are stark. Firstly, the massive drop off of activity in April 2019 prior to the election and the steep / rapid recovery after the election. My second observation is that – despite all the hits we have weathered over the past 12 months – it looks like we’ve landed in exactly the same position as we were this time last year.

What’s next?

With COVID-19 outbreaks in Victoria this week and toilet paper rations back in, it’s clear we’re not out of the woods. This means further uncertainty but the market is absolutely predictable. Uncertain times mean we’ll see an increase in the ‘flight to quality’.

In the current market, this means good quality property is still commanding a good price with some buyers paying 5-10% over the asking price to ensure the purchase. Units in over-supplied areas will take a fairly large hit . . but they won’t ever really be bargains as they will never deliver the longer term results you should expect from a good purchase.

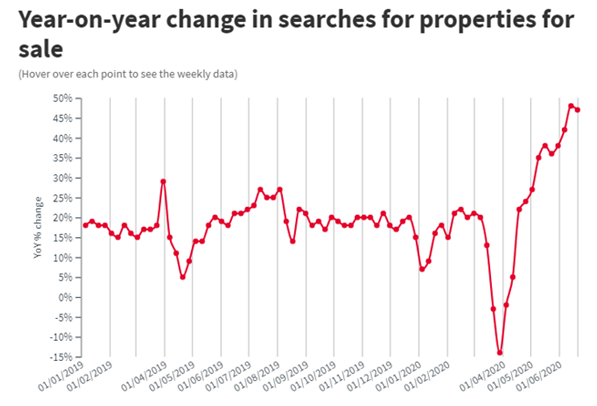

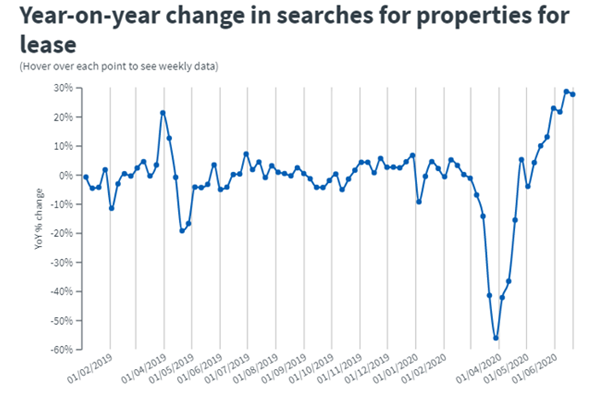

Demand is definitely up – see below for the surge in search activity for both residential and commercial property and I expect to see this trend continue as loan costs remain low and all levels of government work to stimulate the market.

But what should YOU do?

The impacts of COVID-19 have many people re-thinking their accommodation situation, so the idea of selling in the City and buying a couple of income generating properties along with a home by the beach is starting to look like a reasonable choice.

If you’ve been considering a few personal changes, your first step is to review your current position and holdings. This includes outlining your goals and targets . .for example are you seriously considering moving out of the city / dialling back your hours at work / ramping up your investment activity?

To assess your properties, use the information outlined in ‘Relax and get your ratios out ’ and the guidelines in ‘Time for a property review’ if you haven’t read this already.

Need more help?

Sometimes it helps to receive impartial feedback on your position. We specialise in conducting property and portfolio reviews and advising on the ever changing considerations around your decision to hold, sell, upgrade or invest. Send me an email to debra@propertyfrontline.com.au or call on 1300 289 289 if you would like our assistance.

Debra Beck-Mewing

Founder & Director, The Property Frontline

About the author

Debra Beck-Mewing is the Editor of the Property Portfolio Magazine and CEO of The Property Frontline. She has more than 20 years’ experience in buying property Australia-wide and has extensive experience in helping buyers use a range of strategies including renovating, granny flats, sub-division and development. Debra is a skilled property strategist, and a master in identifying tailored opportunities, homes and sourcing properties that have multiple uses. She is a Qualified Property Investment Advisor, licensed real estate agent and also holds a Bachelor of Commerce and Master of Business. As a passionate advocate for increasing transparency in the property and wealth industries, Debra is a popular speaker on these topics. She is also an author, podcast host, and participates on numerous committees including the Property Owners’ Association.

Follow us on facebook.com/ThePropertyFrontline for regular updates, or book in for a strategy session to discuss your property questions.

Disclaimer – This information is of a general nature only and does not constitute professional advice. We strongly recommend you seek your own professional advice in relation to your particular circumstances.