If you’re buying to invest in property, shouldn’t you be aiming to achieve good returns on that investment? If this is true, why do so many people become trapped by the big con of property depreciation?

The big con

A major problem with the property industry is that ‘new’ properties are marketed heavily in order to attract buyers who will pay a premium for their purchase. This results in buyers being presented with misleading information (at best) and often information that is completely false.

One of the key selling points used in relation to new property – for example, house and land packages, or off the plan properties – is the ‘benefits’ of depreciation.

In relation to property, depreciation refers to the practise of claiming a tax deduction on the decline in physical value of a property, the property’s contents and also the costs of owning the property.

To fuel profits, the big developers and property marketers really amp up the false benefits of depreciation. Buyers are presented with spreadsheets showing how much tax they will ‘save’ and aren’t told about the cascading impacts including:

- when it comes time to sell the property, depreciation needs to be paid back

- established properties can be purchased for less than the premium price of new properties and are often better quality properties

- depreciation benefits disappear if a buyer’s income drops – buyers who experience a drop in income may be forced to sell and this drives down the value of other properties in a complex or area

- ‘future’ capital growth may never occur due to the amount of similar properties coming onto the market

- there is usually very little future potential for new property.

Elements of real success

There are many ways to build a successful property portfolio but the base components of yield through rental returns, capital growth, and potential for adding value will determine how quickly you can reach your target, as well as the extent of your success.

The three components are influenced by supply and demand, therefore the aim should be to buy into areas that show obvious signs of good demand (for both rentals as well as property sales), and areas that have some limit to the supply of properties.

When used properly, depreciation can be used to offset losses and costs you carry until well chosen investments start to deliver good returns. The analysis below shows how buying a ‘new’ property for the depreciation ‘benefits’ can lead you into a financial minefield, and how depreciation can still be used effectively when purchasing ‘existing’ properties.

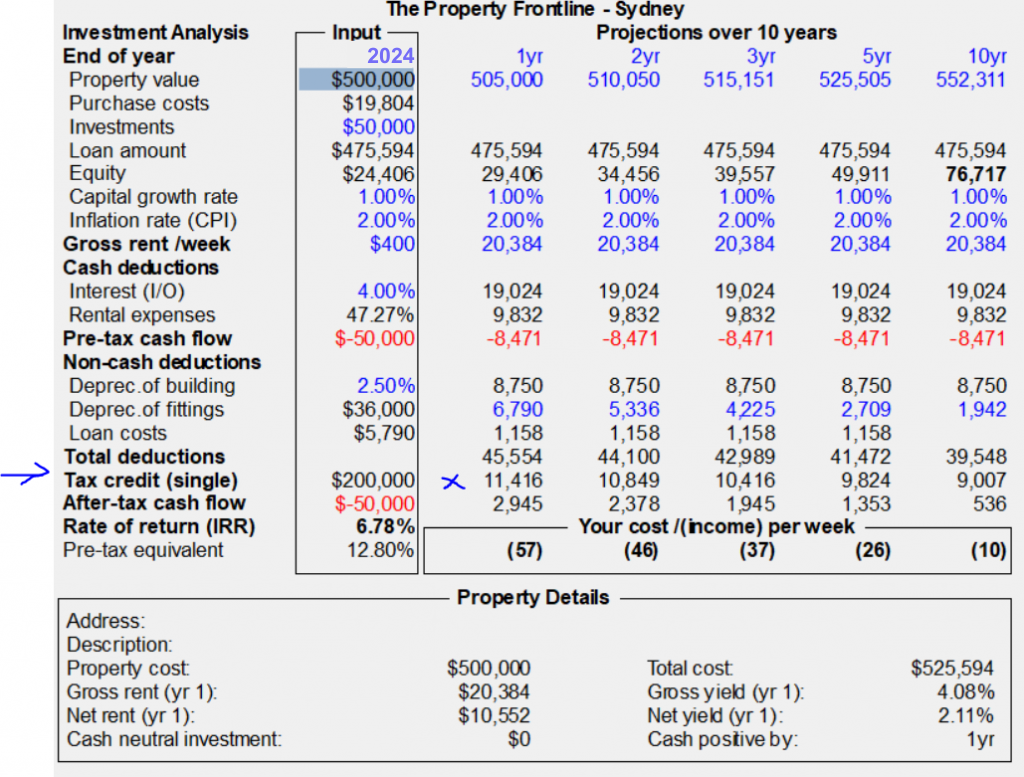

Comparable review – tax deduction

The following table summarises the returns for a ‘new’ property for a buyer on an annual income of $200,000. With a purchase price of $500,000, the table includes depreciation of the building and fittings, and adds strata fees as an extra taxable deduction. Total tax credit = $11,416 in year one.

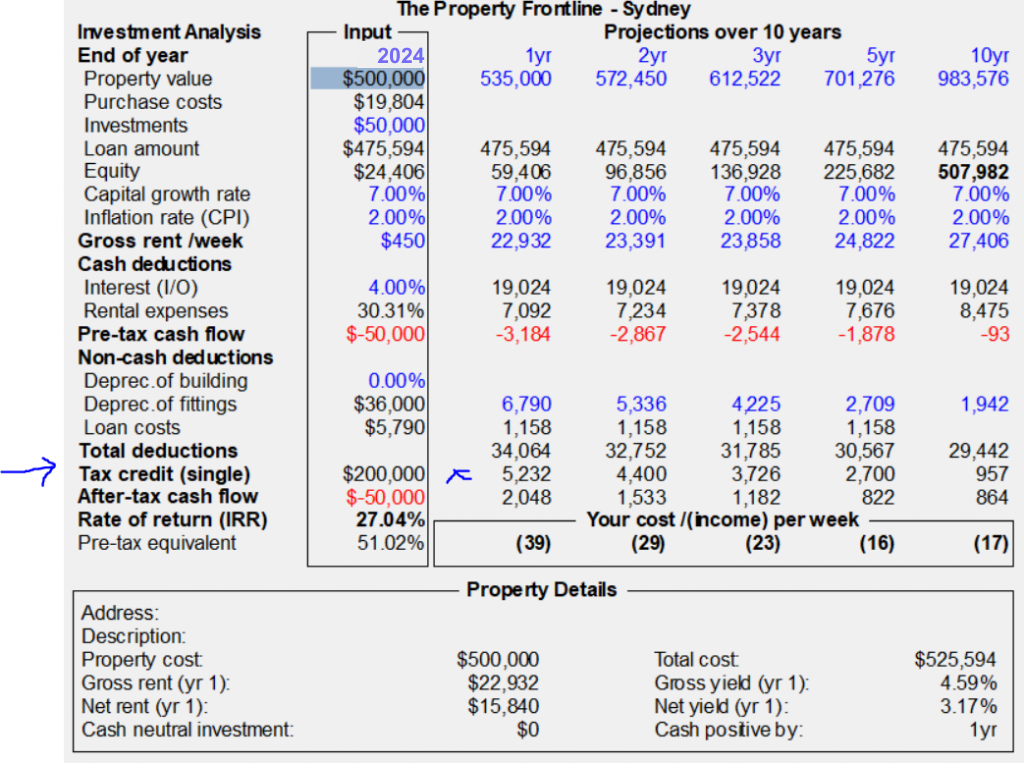

The table below shows results for the purchase of an established property 40+ years old for the purchase price of $500,000. This table excludes depreciation of the building and doesn’t include strata fees as a deduction. Total tax credit = $5,232 in year one.

Comparable – capital growth

In the example above, capital growth from the established property is shown at 7% per year. Of course, capital growth doesn’t occur in a linear fashion but an average of between 5% and 10% can be achieved over a period of five to ten years for a property located in a growing area.

Comparing this to a new property, an investor purchasing an established property would be in a much better position financially as they would have achieved approximately $70,000 in capital growth (equity) within two years. In many cases, new property has negative equity by year two.

Looking for the DIY way to buy?

Check out the new BUYER SUCCESS PROGRAM 👉

Designed to save you time, help you identify problem properties, and increase your ability to negotiate and purchase your ideal property.

Comparable – potential

The amount of potential in a property relates to the ability to add value at a later date and at a time that suits the owner. The scale of potential covers small renovations through to large scale developments.

On this point, new property will typically have zero potential – ie – houses built on small blocks, or apartments with no ability to make changes.

In many cases, potential in a property can result in the ability to turn one property into two by using equity built through the initial purchase.

For example – a property purchased for $500,000 (using the enclosed tables) will have increased in value by approximately $200,000 by year five. These funds can be used to build a secondary dwelling resulting in two properties at $700,000 each – effectively adding another $500,000 of equity and doubling the rental returns.

The message

By all means use depreciation if that’s the best option for your needs, but look at the longer term view. Ensure you use good quality, unbiased information when making any purchase and consider all aspects of each purchase – don’t just look at how much tax you will be ‘saving’ . . .because there’s no doubt you’ll be the one who keeps paying if this is the driving reason for your next property purchase.

For more information on this topic > The Truth About Existing v New Property and Top Five Lies You’re Told About New Property.

About the author

Debra Beck-Mewing is the Editor of the Property Portfolio Magazine and CEO of The Property Frontline. She has more than 20 years’ experience in buying property Australia-wide and has extensive experience in helping buyers use a range of strategies including renovating, granny flats, sub-division and development. Debra is a skilled property strategist, and a master in identifying tailored opportunities, homes and sourcing properties that have multiple uses. She is a Qualified Property Investment Advisor, licensed real estate agent and also holds a Bachelor of Commerce and Master of Business. As a passionate advocate for increasing transparency in the property and wealth industries, Debra is a popular speaker on these topics. She is also an author, podcast host, and participates on numerous committees including the Property Owners’ Association.

Follow us on facebook.com/ThePropertyFrontline for regular updates, or book in for a strategy session to discuss your property questions.

Disclaimer – This information is of a general nature only and does not constitute professional advice. We strongly recommend you seek your own professional advice in relation to your particular circumstances.